Little Known Questions About Paul B Insurance Local Medicare Agent Huntington.

Wiki Article

What Does Paul B Insurance Medicare Agency Huntington Mean?

Table of ContentsThe Buzz on Paul B Insurance Insurance Agent For Medicare HuntingtonPaul B Insurance Medicare Agent Huntington - TruthsRumored Buzz on Paul B Insurance Medicare Advantage Agent HuntingtonThe Ultimate Guide To Paul B Insurance Insurance Agent For Medicare HuntingtonPaul B Insurance Local Medicare Agent Huntington for Beginners

When you make use of the Medicare Select network medical facilities and suppliers, Medicare pays its share of authorized costs and the insurance provider is accountable for all extra advantages in the Medicare Select policy. As a whole, Medicare Select plans are not called for to pay any advantages if you do not use a network service provider for non-emergency solutions.Presently no insurance firms are supplying Medicare Select insurance policy in New york city State. Medicare Advantage Plans are accepted and also regulated by the federal government's Centers for Medicare and Medicaid Provider (CMS). For information relating to which Strategies are available and the Plan's advantages and also premium prices, please contact CMS directly or see CMS Medicare website.

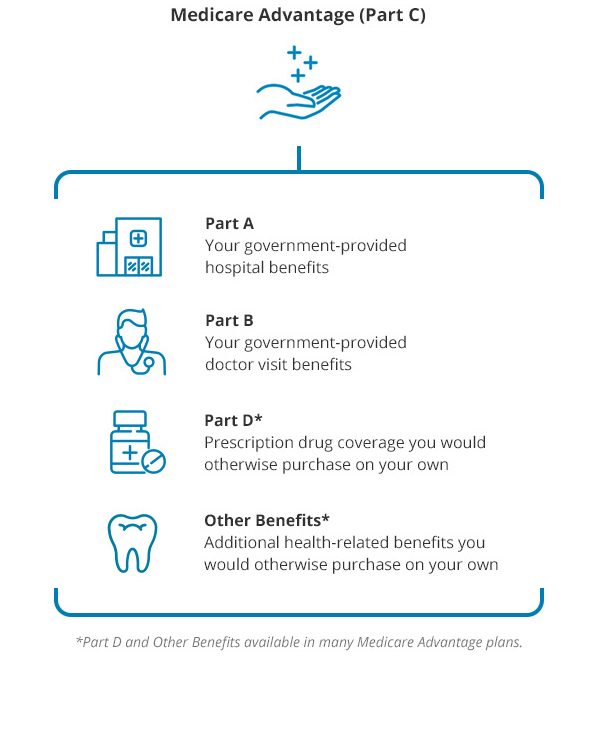

What is Medicare Advantage? What are the benefits and limitations of Medicare Advantage plans? Are there any defenses if I enroll in a strategy and also do not like it? Are any kind of Medicare Managed Treatment Program offered where I live? Medicare Advantage broadens healthcare alternatives for Medicare recipients. paul b insurance Medicare Supplement Agent huntington. These choices were produced with the Balanced Spending Plan Act of 1997 to minimize the growth in Medicare spending, make the Medicare trust fund last much longer, and also offer beneficiaries a lot more options.

What Does Paul B Insurance Insurance Agent For Medicare Huntington Mean?

Original Medicare will certainly constantly be available. This is a handled treatment plan with a network of companies who acquire with an insurance firm.

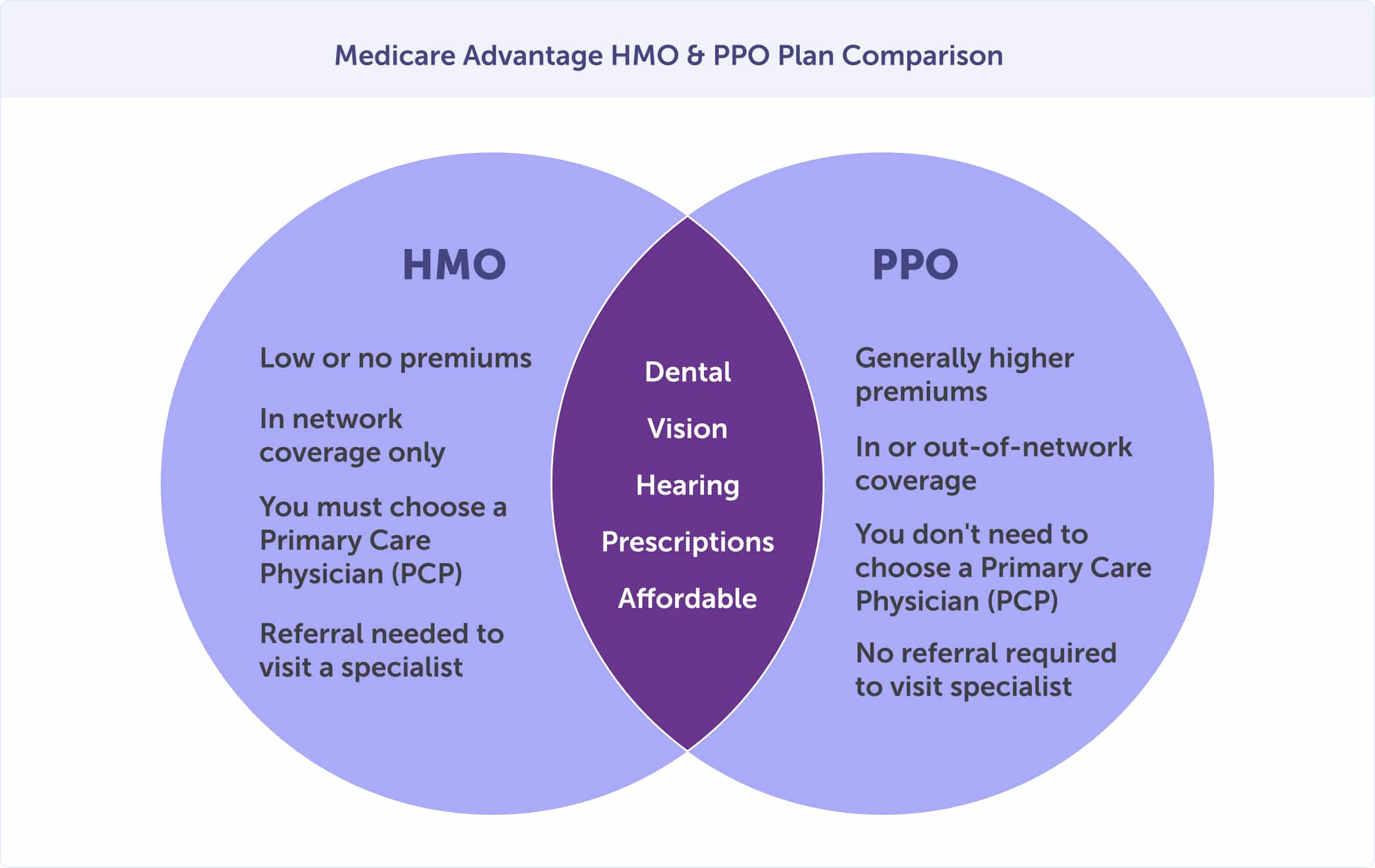

You agree to adhere to the guidelines of the HMO and also utilize the HMO's suppliers. This resembles the Medicare Benefit HMO, except you can utilize providers outside of the network. You will pay greater deductibles and also copayments when you go outside of the network. This is another handled treatment strategy.

This is an insurance policy strategy, not a managed care plan. The strategy, not Medicare, establishes the cost timetable for providers, however carriers can bill up to 15% more.

Paul B Insurance Insurance Agent For Medicare Huntington - Questions

This is just one of the taken care of treatment plan types (HMO, HMO w/pos, PPO, PSO) which is formed by a religious or fraternal company. These strategies might limit registration to participants of their organization. This is a health insurance coverage plan with a high deductible ($3,000) combined with a cost savings account ($2,000).

Medical professionals have to be allowed to notify you of all treatment choices. The strategy needs to have a complaint and also allure treatment. If a layperson would think that a symptom could be an emergency, then the plan needs to spend for the emergency situation treatment. The plan can not bill even more than a $50 copayment for brows through to the emergency clinic.

All plans have an agreement with the Centers for Medicare and Medicaid Solutions (Medicare). The plan should enlist any person in the solution area that has Part An and also Component B, other than for end-stage renal disease clients.

Some Known Questions About Paul B Insurance Medicare Supplement Agent Huntington.

You pay any kind of plan premium, deductibles, or copayments. All plans may supply Click This Link fringe benefits or services not covered by Medicare. There is typically less documentation for you. The Centers for Medicare and Medicaid Services (Medicare) pays the plan a collection quantity for each and every month that a beneficiary is registered. The Centers for Medicare and Medicaid Solutions checks allures and also marketing plans.

If you satisfy the following demands, the Medicare Advantage plan should enroll you. You might be under 65 as well as you can not be denied coverage due to pre-existing conditions. You have Medicare these details Component An and also Component B.You pay the Medicare Part B premium. You stay in an area serviced by the strategy.

You are not getting Medicare due to end-stage kidney disease. You have Medicare Component An as well as Part B, or just Component B.You pay the Medicare Part B costs.

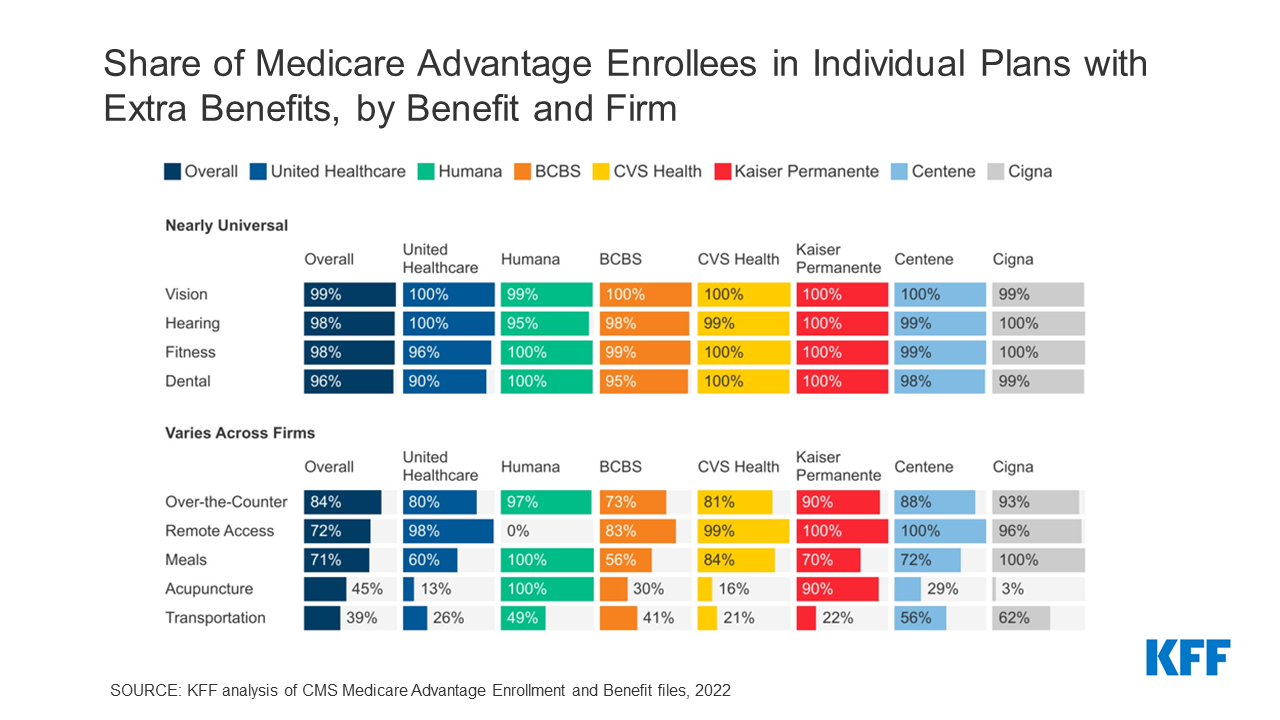

Medicare Advantage strategies have to supply all Medicare covered services and also are authorized by Medicare. Medicare Benefit strategies might supply some services that Medicare does not usually cover, such as regular physicals as well as foot treatment, oral treatment, eye exams, prescriptions, listening to aids, and also other precautionary services. Medicare HMOs might provide some services that usaa life insurance Medicare doesn't typically cover, such as regular physicals and foot treatment, dental treatment, eye tests, prescriptions, hearing help, and various other preventive solutions.

Some Ideas on Paul B Insurance Medicare Part D Huntington You Need To Know

You do not require a Medicare supplement plan. You have no expenses or insurance claim kinds to finish. Filing as well as arranging of claims is done by the Medicare Advantage strategy. You have 24-hour accessibility to solutions, consisting of emergency or urgent care with providers outside of the network. This includes foreign travel not covered by Medicare.Report this wiki page